The Influence of Historical Events on Art Prices

How Global Events Shape the Market

Art has always been a mirror of history , reflecting the political upheavals, cultural renaissances, and global crises of its time. But beyond its aesthetic and cultural significance, art also plays a crucial role in the financial world. The value of paintings, sculptures, and other creative works often rises or falls in tandem with historical shifts. Understanding how historical events influence art prices reveals a fascinating intersection between culture, psychology, and economics.

In this article, we will explore how global events shape art prices, why art values often spike after turbulent times, and the hidden link between history and market value , culminating in a historical look at art market booms that continue to define the financial and cultural landscape.

The Historical Connection Between Art and Economics

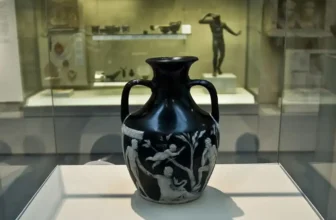

Throughout history, art has not only served as creative expression but also as a store of value. Unlike stocks or commodities, art’s value lies in its uniqueness , no two works are exactly the same. Yet, this value is far from static. It evolves with the social, political, and economic tides of history.

During stable and prosperous times, art tends to flourish as a collectible luxury. But during or after turmoil , wars, depressions, revolutions, pandemics , art values can behave in surprisingly counterintuitive ways. In many cases, historical crises actually lead to increased long-term valuations of certain artworks and artists.

This dynamic is deeply rooted in psychology: when uncertainty grips markets, investors often seek tangible, enduring assets. Art, with its scarcity and cultural prestige, becomes an appealing hedge against volatility.

How Global Events Shape Art Prices

1. Wars and Political Upheavals

War and political instability often cause immediate chaos in financial markets , yet they also reshape art values in enduring ways.

During wartime, art markets typically contract. Collectors focus on survival rather than acquisition, galleries close, and trade routes are disrupted. However, post-war periods often see dramatic rebounds. For example:

Post–World War II Boom (1945–1960s): After years of global conflict, a wave of prosperity swept through Europe and the United States. With economies rebuilding and optimism returning, collectors sought meaning and investment in modern art. This era saw a massive surge in the value of works by Jackson Pollock, Mark Rothko, and Pablo Picasso.

The Cold War Influence: The ideological battle between capitalism and communism also extended to culture. The U.S. government and elite collectors promoted Abstract Expressionism as a symbol of creative freedom, fueling demand and prestige for American modern art.

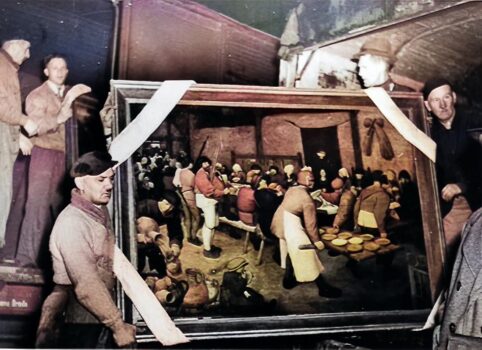

Wars also trigger displacement and loss , leading to looted or stolen art resurfacing decades later, often at astronomical prices. Provenance, scarcity, and historical context amplify value. A painting with wartime provenance often carries a richer narrative, and collectors pay a premium for that story.

2. Economic Booms and Crashes

Financial markets and art prices have long been intertwined. Economic prosperity creates new millionaires who often invest in art both for status and diversification. Conversely, recessions expose overvalued works and speculative bubbles.

The Roaring Twenties: Economic exuberance before the Great Depression led to booming art markets, especially for Impressionist and Post-Impressionist works. Wealthy industrialists collected Renoir, Monet, and Cézanne as cultural trophies.

The Great Depression (1930s): Art sales plummeted as liquidity evaporated. Yet, works acquired cheaply during this period later became priceless. For instance, several masterpieces now in major museums were bought for modest sums in the 1930s , proving that crisis periods often plant the seeds of future appreciation.

The 1980s Boom: Fueled by globalization and financial deregulation, the 1980s saw unprecedented speculation in contemporary art. Artists like Jean-Michel Basquiat and Keith Haring became cultural icons, and Japanese collectors bid record sums for Impressionist paintings.

The 2008 Financial Crisis: Initially, art sales slowed sharply. But by 2010, recovery was swift, driven by ultra-wealthy investors seeking stable, tangible assets. Blue-chip artists such as Warhol, Hirst, and Koons achieved record-breaking prices. Art proved resilient , functioning almost like “cultural gold.”

Economic history shows that while short-term crises may shake art prices, long-term trends often favor appreciation. Art retains , and often enhances , its value over decades, particularly for established artists.

3. Technological Shifts and Cultural Revolutions

Global events are not limited to wars and recessions. Technological revolutions have profoundly changed the art market, influencing accessibility, valuation, and demand.

Photography and Modernism (19th–20th century): The invention of photography pushed painters to innovate. Movements like Impressionism and Cubism emerged, transforming artistic value perception.

The Internet and Globalization (1990s–2000s): Online auctions and digital platforms democratized access to art markets. Sotheby’s and Christie’s expanded globally, enabling Asian, Middle Eastern, and Latin American collectors to participate actively.

NFTs and Digital Art (2020–present): The rise of blockchain and non-fungible tokens (NFTs) introduced a new dimension to art ownership. The 2021 sale of Beeple’s Everydays: The First 5000 Days for $69 million at Christie’s marked a new chapter in art history , blending technology, speculation, and creativity. Though volatile, the digital art revolution mirrors how past technological milestones redefined value paradigms.

Why Art Values Spike After Turbulent Times

It may seem paradoxical that art prices rise following crises. Yet history repeatedly confirms this pattern. Here’s why:

1. Art as a Safe Haven Asset

In times of uncertainty , whether economic or political , investors look for assets uncorrelated with traditional markets. Like gold or real estate, art offers a tangible hedge. Unlike fiat currency, it cannot be devalued by inflation or government policy. Wealthy individuals often shift capital into art to preserve wealth discreetly, especially during high inflation or political instability.

2. The Psychology of Meaning

Crisis often breeds introspection. After traumatic global events, society tends to seek meaning and cultural rebirth. Art embodies that process. Collectors gravitate toward works that capture resilience, human emotion, and renewal. This emotional connection drives demand , and prices.

For example, the years following the 1918 influenza pandemic saw a creative explosion in modern art movements. Similarly, post-2020 pandemic years witnessed surging prices for works by artists exploring themes of isolation, resilience, and transformation.

3. Limited Supply and Increased Prestige

Art is a finite commodity. When crises disrupt production, transport, or trade, supply temporarily contracts. Moreover, artworks tied to historical moments , such as war-era or post-crisis creations , often carry enhanced prestige. The scarcity and symbolic weight drive collectors to pay premiums.

4. Institutional Buying and Market Confidence

After turbulence, major institutions like museums, galleries, and auction houses often play stabilizing roles. Their renewed acquisitions and high-profile exhibitions reignite market confidence. Record-breaking auctions act as psychological catalysts, triggering further appreciation.

For example, the record-breaking $450 million sale of Leonardo da Vinci’s Salvator Mundi in 2017 occurred during geopolitical uncertainty, reaffirming art’s status as a “crisis-proof” luxury asset.

The Hidden Link Between History and Market Value

Art prices don’t just reflect supply and demand , they encapsulate the collective memory of civilizations. Each historical epoch leaves its fingerprint on artistic value in subtle ways.

1. Provenance and Historical Narrative

A painting’s history , its owners, exhibitions, or connection to historical events , can drastically influence value. For instance, artworks once owned by royal families or political figures carry prestige beyond their aesthetic merit. The “story” embedded in the piece becomes part of its price.

2. Political Shifts and Cultural Realignment

When empires fall or regimes change, art often becomes a symbol of identity and resistance. Consider how Russian avant-garde art gained renewed interest after the fall of the Soviet Union, or how Chinese contemporary art exploded in value following the country’s economic liberalization in the 1990s.

3. Cultural Memory and Reappraisal

Over time, history reshapes taste. Artists once dismissed may later be reappraised as visionaries. Historical distance allows critics and collectors to rediscover and reinterpret works within new contexts. This phenomenon , known as retrospective valorization , has driven the meteoric rise of artists like Vincent van Gogh and Hilma af Klint, whose recognition blossomed decades after their deaths.

4. Global Power and Wealth Distribution

Art markets follow money , and money follows global power shifts. As wealth migrated from Europe to the United States after World War II, American art rose to dominance. In the 21st century, as Asia and the Middle East accumulate wealth, art fairs and auction houses have expanded to Hong Kong, Dubai, and Seoul. These shifts not only diversify collectors but also redefine which artists and movements command global prestige.

A Historical Look at Art Market Booms

To understand how deeply intertwined history and art prices are, let’s review some of the most notable art market booms of the past century.

The Post-War Boom (1945–1960s)

After the devastation of World War II, a wave of optimism and prosperity swept across the Western world. Governments invested in culture, and the United States emerged as a new global art hub. New York overtook Paris as the center of modern art, and the works of Pollock, de Kooning, and Rothko skyrocketed in value.

Collectors, corporations, and museums began treating art as both cultural capital and financial investment. Abstract Expressionism’s boldness mirrored postwar confidence , and prices soared accordingly.

The Japanese Boom (1980s)

Japan’s economic miracle fueled one of the most dramatic art market surges in history. Flush with cash, Japanese collectors paid record sums for Impressionist and Post-Impressionist masterpieces. In 1990, Japanese paper magnate Ryoei Saito famously purchased Van Gogh’s Portrait of Dr. Gachet for $82.5 million , then the highest price ever paid for a painting.

When Japan’s bubble burst in the 1990s, the art market corrected sharply , underscoring its sensitivity to macroeconomic cycles.

The Globalization Era (2000–2010s)

The new millennium brought rapid globalization, digital innovation, and emerging wealth from China, Russia, and the Middle East. Auction houses expanded globally, and art became a symbol of international status.

Record-breaking sales became common:

Picasso’s Nude, Green Leaves and Bust sold for $106.5 million (2010)

Munch’s The Scream fetched $119.9 million (2012)

Leonardo’s Salvator Mundi achieved $450.3 million (2017)

Each sale reinforced art as both luxury commodity and asset class, often outperforming traditional investments over time.

The Post-Pandemic Renaissance (2021–present)

The COVID-19 pandemic initially froze galleries and auctions. But as digital platforms evolved, online art sales surged. Wealthy collectors, confined at home, redirected spending from travel to art acquisition.

By 2022, the art market had fully rebounded. Sotheby’s and Christie’s posted record revenues. Works by emerging artists and historically underrepresented groups , especially women and artists of color , gained unprecedented visibility and value. The market also diversified into NFTs and digital formats, ushering in a new hybrid age of collecting.

What Drives Art Prices in the Long Run

Analyzing centuries of art market behavior yields clear insights:

Crisis fuels creativity , and eventually, demand.

Scarcity and narrative elevate value beyond material worth.

Global power shifts redirect art’s financial centers.

Cultural memory and reappraisal can transform forgotten artists into icons.

Technology democratizes markets, expanding access and competition.

Ultimately, while short-term volatility reflects external shocks, art’s long-term trajectory remains upward. The market rewards authenticity, innovation, and historical resonance.

Art as History’s Financial Echo

Every brushstroke tells a story , and every price tag reflects history’s echo. From wars to pandemics, booms to busts, the influence of historical events on art prices is undeniable. Art does not merely survive history; it translates it into value.

Global events shape art markets not only by altering wealth distribution but by transforming collective meaning. That’s why art prices often spike after turbulent times: they represent both refuge and rebirth. Collectors, investors, and historians alike see in art a lasting reminder that creativity endures , and appreciates , even amid chaos.

In the end, the hidden link between history and market value reveals that art’s worth is never just about pigment on canvas or marble carved to perfection. It’s about humanity’s ongoing dialogue with its past , and the willingness to pay for the privilege of preserving it.