Antique Oil Paintings vs. Modern Art: Which Holds Better Value

The world of art collecting is vast, intricate, and deeply tied to history, culture, and economics. For centuries, antique oil paintings have been celebrated as treasures of the past, while in recent decades, modern art has surged in popularity, reshaping the dynamics of art investment. For collectors, investors, and art enthusiasts alike, one pressing question arises: Which holds value better, antique oil paintings or modern art?

This comprehensive guide will examine the history, value determinants, market trends, and long-term investment potential of both categories. Whether you are considering purchasing your first painting or expanding your collection, understanding the differences between antique and modern art is key to making informed decisions.

What Are Antique Oil Paintings?

Antique oil paintings generally refer to artworks that are over 100 years old, created using traditional oil paints on canvas, wood, or linen. These works often originate from notable art movements such as:

Renaissance (14th–17th century): Masters like Raphael, Titian, and Leonardo da Vinci elevated oil painting into a high art form.

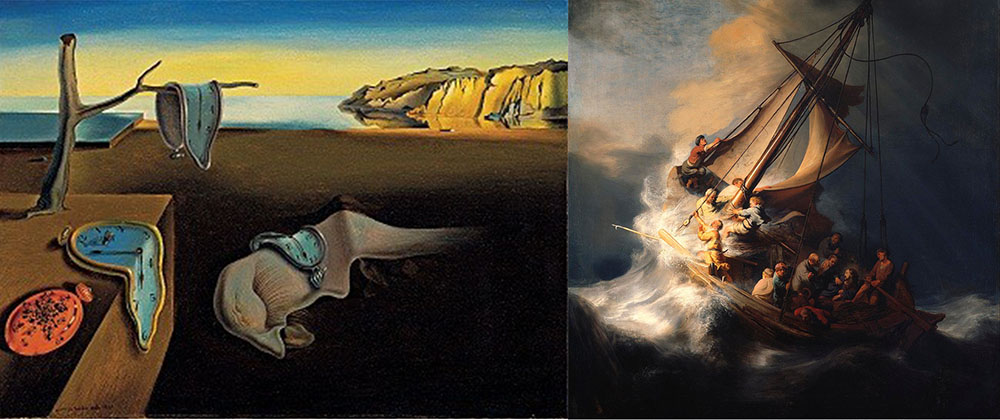

Baroque (17th century): Caravaggio, Rembrandt, and Rubens introduced dramatic lighting and religious themes.

Romanticism & Neoclassicism (18th–19th century): Artists like Goya, David, and Delacroix emphasized emotion and grandeur.

Impressionism & Post-Impressionism (late 19th century): Monet, Van Gogh, and Cézanne broke traditional forms and shaped modern sensibilities.

Because of their age, scarcity, and historical significance, antique oil paintings often carry immense cultural and monetary value.

What Is Modern Art?

Modern art, broadly spanning from the late 19th century to the 20th century, represents a radical departure from traditional forms. Movements include:

Cubism: Picasso and Braque’s fragmented perspectives.

Abstract Expressionism: Jackson Pollock’s action painting and Rothko’s color fields.

Surrealism: Salvador Dalí and René Magritte’s dreamlike compositions.

Pop Art: Andy Warhol and Roy Lichtenstein’s commercialized imagery.

In today’s market, contemporary art (21st century) is often included in discussions of “modern” collecting. Artists like Banksy, Yayoi Kusama, and Jeff Koons command record-breaking prices at auction.

Key Factors That Determine Value

Whether antique or modern, art value depends on several universal elements:

Provenance: The documented history of ownership and authenticity.

Artist Reputation: Works by renowned masters appreciate more reliably.

Rarity & Scarcity: One-of-a-kind or limited pieces hold stronger value.

Condition: Well-preserved paintings sell for significantly more.

Market Trends: Fluctuations in taste, cultural relevance, and investor demand.

Cultural Significance: Pieces that shaped or represent historical eras maintain high demand.

Why Antique Oil Paintings Hold Value

Historical Significance:

Antique works are direct links to cultural history. Collectors often see them as irreplaceable artifacts.Scarcity:

No new Old Master paintings can ever be produced. Their rarity guarantees long-term appreciation.Prestige & Legacy:

Ownership of a Raphael, Rembrandt, or Monet confers elite status, which adds to desirability.Stable Market:

While prices fluctuate, antiques tend to remain more stable over decades compared to the volatility of modern works.Museum Backing:

Many masterpieces are already in institutions, further reducing availability and increasing private collectors’ interest.

Why Modern Art Holds Value

Cultural Relevance:

Modern and contemporary works often reflect current social, political, and cultural dialogues.High Market Demand:

Global collectors, especially from emerging economies, are increasingly investing in modern and contemporary works.Auction Performance:

Modern art frequently dominates auction houses like Christie’s and Sotheby’s with record-breaking sales.Trend-Driven Growth:

Works by artists like Basquiat and Banksy have skyrocketed in value within decades.Accessibility for New Collectors:

Compared to centuries-old masters, some modern art pieces are more financially attainable entry points.

Antique Oil Paintings vs. Modern Art: Investment Comparison

| Factor | Antique Oil Paintings | Modern Art |

|---|---|---|

| Age & Rarity | Limited supply, no new works created | Constantly evolving, many new artists emerging |

| Market Stability | Long-term stability, gradual appreciation | Volatile, influenced by trends and hype |

| Cultural Value | Deep historical significance | Contemporary relevance |

| Price Range | High entry price for known masters | Ranges from affordable to record-breaking |

| Auction Performance | Steady results | High volatility with potential huge returns |

| Preservation Needs | Requires expert care, restoration | Generally less fragile (but still sensitive) |

Notable Record Sales

Antique Masterpieces:

Salvator Mundi by Leonardo da Vinci sold for $450.3 million (2017).

A Rembrandt self-portrait fetched $18.7 million (2020).

Modern & Contemporary Works:

Shot Sage Blue Marilyn by Andy Warhol sold for $195 million (2022).

Untitled by Jean-Michel Basquiat sold for $110.5 million (2017).

These figures highlight that both categories are capable of astronomical valuations, but modern art often sets more frequent record-breaking prices in recent years.

Risks of Investing in Antique Paintings

Authentication Challenges: Forgeries and misattributions can mislead buyers.

Restoration Costs: Preserving centuries-old works can be expensive.

Liquidity: Selling antique masterpieces can take time due to limited buyers.

Market Saturation: Lower-tier antique works may not appreciate as significantly.

Risks of Investing in Modern Art

Volatility: Prices can fluctuate dramatically based on trends.

Oversupply: Many modern artists flood the market, reducing long-term value.

Fads vs. Legacy: Not every contemporary artist will withstand the test of time.

Provenance Issues: Emerging artists often lack long-documented ownership history.

Which Holds Value Better?

The answer depends on your investment goals and collecting philosophy:

If you value stability, historical importance, and cultural heritage, antique oil paintings may be the stronger choice. Their scarcity and proven longevity ensure lasting worth.

If you seek rapid appreciation, cultural relevance, and are open to risk, modern art could deliver higher short-term gains, though with greater volatility.

Ultimately, many high-net-worth collectors diversify by owning both categories.

How to Start Collecting Antique Oil Paintings

Research periods, schools, and artists.

Buy from reputable dealers or auction houses.

Verify provenance and authenticity.

Consult art historians or appraisers.

Consider insurance and climate-controlled storage.

How to Start Collecting Modern Art

Visit galleries, art fairs, and exhibitions.

Study emerging and established artists.

Follow auction results for pricing benchmarks.

Support living artists directly.

Balance trend-driven purchases with enduring works.

The Future of Art Investment

Technology: Blockchain and NFTs are transforming how provenance is tracked.

Globalization: Demand for both antique and modern art is growing in Asia and the Middle East.

Sustainability: Modern art often engages with environmental and social issues, attracting younger investors.

Institutional Interest: Museums continue acquiring both categories, influencing market value.

By strategically weaving these terms into headings and descriptions, the content aligns with common search queries by art collectors and investors.

Antique vs. Modern – A Balanced Approach

The debate over antique oil paintings vs. modern art is less about which is “better” and more about what aligns with your goals as a collector. Antique masterpieces provide timeless prestige, cultural heritage, and stability, while modern works offer bold innovation, cultural resonance, and rapid appreciation potential.

The most successful collectors often embrace both worlds, anchoring their portfolios with antique oil paintings for stability while leveraging modern art for growth. In the end, art should not only be about financial gain but also personal passion and enjoyment. image/ Moma